In the cottage industry that is health care, there are many interstitial spaces between health care trading partners that are involved in a patient’s care. Like in biology, interstitial spaces are of interest because this is where critical connections and communications occur.

Each health care trading partner in a community has their own information system, many of which are EMRs or have EMR-like features, for collecting and managing patient health care data. These systems are focused on the operation and workflow within the individual trading partner with little or no support for the kinds of information exchanged between trading partners.

What is missed by enterprise-focused EMRs are the high volume of transactions and communications that occur between health care trading partners as a consequence of providing patient care. Interstitial transactions and communications include patient data, but as a complement to the care transitions and care coordination that occupies the interstitial space between trading partners.

These enterprise systems are of little help in facilitating communications between different health care trading partners due to a lack of interoperability. Today, the most common methods for this interstitial communication are fax machines and person-to-person phone calls.

Why Interstitial Communication Is Important

In health care, interstitial communications among trading partners is focused on care transitions: discharge planning, post discharge follow up to minimize readmissions, referrals, ordering drugs, therapy or diagnostic services available outside the enterprise. Care coordination is also a major focus with care plan development and coordinating care plan execution across trading partners and provider-to-provider consultations. Payor transactions for eligibility lookup, referrals and pre-approvals are also part of interstitial communications.

These transactions are essential to the successful conclusion of a patient’s episode of care, one that often extends way beyond the hospital and physicians. Current interstitial communications are labor intensive, and susceptible to human error.

Change Drivers

The continued digitization of health care is increasing pressure on remaining manual processes, be they manually recording medical device data into the EMR or the interstitial communications noted above. As the “post EMR era” continues to come into focus, one persistent theme that pertains to interstitial communications is patient-centered care. In fact, many of the interstitial transactions mentioned above relate directly to patient-centered care. Most efforts to date have focused on patient-centered care within the enterprise. The effort to extend that focus to health care trading partners is nascent at best.

Some interstitial use cases have external incentives driving adoption created by regulations or reimbursement policy, such as reduced reimbursement for certain types of readmissions. Electronic prescribing and chronic care management (pdf) also fall under this "external incentives" category.

Meaningful Use requirements for EMRs certified by the ONC include standardization that facilitates some degree of interoperability – this too is helping to drive a subset of interstitial communications.

Vertical integration in health care has been a big trend since the advent of the Accountable Care Act of 2010. Hospitals have acquired many physician practices and other health care trading partners. Not all markets or health care communities are suited to vertical integration, either because of too many strong competitors or potential antitrust issues. The desire to apply an enterprise solution to address interstitial communications may be strong but is not an effective means to tie in the inevitable trading partners who lie outside the vertically integrated enterprise.

Another outcome of the Affordable Care Act is the creation of Accountable Care Organizations or ACOs. ACOs are a network of doctors and hospitals that share financial and medical responsibility for patients. In some important ways, the ACO is a regulatory way to impose vertical integration on health care delivery. The information systems used to manage ACOs are enterprise applications that must be adopted by each ACO participant trading partner (an expensive and disruptive process). ACOs have yet to be proven out as they have not demonstrated clear savings or improved outcomes. Some ACOs have quit and there is concern that the market consolidation resulting from ACOs (just like with vertical integration spurred by the ACA) could result in reduced competition and lead to higher prices.

Perhaps the ultimate driver for automating interstitial communications among trading partners is the universal dislike of having to conduct business via phone calls and fax machines. These inefficient methods only exist because better solutions have yet to emerge.

Awareness of this need to automate interstitial transactions is growing as witnessed by a recent article in Forbes, Free Healthcare From the Fax. This article has a very enterprise and EMR centric perspective, but clearly calls out the problem with too many health care communications and transactions being accomplished via fax and phone calls.

Even the tech giants from Silicon Valley are making a public commitment to solve the health care interoperability problem. Exactly how they will do this is not clear, as none of them develop and sell EMRs nor participate in the automation of health care transactions to any degree. But certainly, their earnest commitment to “do something” is a welcome contribution.

No less than the Administrator of the Office for the National Coordinator, Seema Verma, has announced a goal to automate transactions between health care trading partners. In a recent speech her stated goal is to, “…make every doctor’s office in America a fax free zone by 2020!” While Verma goes into great detail about the problems and challenges around communications between health care trading partners, a credible policy framework is yet to be presented.

Barriers to Adoption

Due to the enterprise focus of the health care industry overall, interstitial markets are still unrecognized by many. And those that see these interstitial communications needs are often unsure what a solution would look like or how to go about gaining adoption. An episode of care often extends beyond the hospital and physician’s office, to include many of the trading partners included in the diagram at the top of this post. The farther communications get beyond the hospital and physician, the more difficult it is to replace phone calls and fax machines due to inherent limitations of enterprise applications.

Interstitial markets often include a network effect component. The network effect is traditionally defined as a system where each new user on the network increases the value of the service for all others. Consider the network effect with fax machines – being the first to own one is of zero value. Being the 1 millionth to buy one has tremendous value. In a new market, like automating the transactions now done over the phone and fax, the network effect starts out as a barrier to entry – the dearth of participants in the network limits value. It is only after some success that the network effect may spur more rapid adoption.

To make this successful, interstitial solutions must garner a level of adoption that delivers enough value to the health care community. For a variety of reasons, the network effect in health care delivery is neither quick, easy, nor a certainty. When successful, the network effect can have a powerful impact on market adoption, customer lock-in and erecting competitive barriers. Both go-to-market strategy and product design have a big impact on the ability to first overcome and then leverage the network effect.

Many health care trading partners have proprietary feelings towards the patient data in their information systems. The idea of opening up their databases to other trading partners in their community, some of whom are competitors, is not appealing. Fortunately, most of the interstitial communication content is of limited proprietary or competitive value and must be communicated to deliver patient care. Interstitial solutions that limit their scope to enabling interstitial transactions and just the patient data required to transition or coordinate care will find fewer objections about sharing data.

Existing enterprise information systems are commonly designed as proprietary end-to-end solutions. As such there is little interoperability between different vendor’s systems other than what is mandated by Meaningful Use requirements for certified EMRs. Established health care IT vendors apparently see little upside for them as they continue to drag their feet in adopting meaningful interoperability between their EMR systems.

Regardless of the degree of interoperability between EMRs, the fact remains that few of the transactions between health care trading partners are supported by EMRs. Interstitial communications is a use case that is mostly removed from EMR interoperability, despite efforts to paint the EMR as the center of the health care automation universe.

Early Interstitial Market Solutions

When many think of interstitial communications solutions, they think of regional Health Information Exchanges (HIE) that make patient data from enterprise EMRs available to other health care trading partner’s EMRs. Over their 20 year history, the availability and success of HIEs has been spotty. A principal reason is that the HIE is still in search of a viable business model. It seems few health care trading partners are willing pay for HIE services to a level that covers their costs, let alone makes a profit. Besides interoperability challenges, health care trading partners' concerns about patients being poached by local competitors may be another factor limiting HIE growth.

Some HIEs are extending their EMR data-oriented solutions to include interstitial communications transactions. An example of this type of organization is OneHealthPort, that was created to “…solve information exchange and workflow problems shared across healthcare organizations.” This organization is a follow up to a late 1990’s startup called Pointshare whose mission was to automate common transactions between health care trading partners. Pointshare started in the Pacific Northwest and was acquired by Siemens at the end of 2001, after the Internet bubble burst. The company made enough of an impact on providers that OneHealthPort was constituted to provide many of the same transaction services as Pointshare.

Sue Merk, EVP of Innovation for OneHealthPort, describes it (emphasis mine):

For clinical practices trading with other clinical practices we are leveraging the fact that certified [EMR] systems must meet certain interoperability standards about how to trade data, what data and data formats are used and how to connect securely. So, in our case we are able to do things to help people because they are using systems with capabilities or we have invested in helper capabilities to get them across the gap.

It would seem that this focus on interoperability standards and these helper capabilities allow OneHealthPort to provide more value than a typical HIE.

Another example of an interstitial health care solution is CollectiveMedical (CMT) that targets care coordination for community emergency room physicians. CMT provides analytics and workflow intelligence to help simplify decision making instead of just presenting the basic health data like a traditional HIE.

A third example is the Medical Information Network – North Sound (MIN-NS). MIN-NS includes HIE services, but also offers additional capabilities like telehealth, emergency department care plans and direct secure messaging.

Another avenue of innovation for interstitial communications is the use of health care messaging and orchestration systems. Some of these systems have been designed from the ground up to support multiple trading partners in a health care community. Combined with workflow automation capabilities that many of these systems have, there is the potential to greatly reduce the friction between trading partners by eliminating phone calls and fax machines and providing users with automated work lists for data that can’t be integrated with trading partner enterprise information systems.

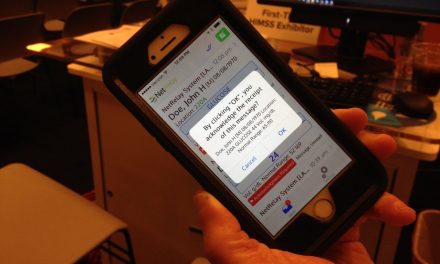

A good case study of an interstitial solution in general, and a specific example of a messaging solution explicitly targeting communications between health care trading partners is Pulsara. Founded in 2013, Pulsara started out providing inter-enterprise communications targeting EMS and hospitals dealing with STEMI and stroke. With 60 EMS agencies and 30 hospitals in 20 states, Pulsara is extending to new use cases (e.g., inter-facility transfer centers) that leverage interstitial communications among trading partners in a health care community.

More examples of potential interstitial apps include patient engagement, care coordination, chronic care management and care plan management, electronic prescribing and more. These apps will need to make the transition from an enterprise centric to an interstitial orientation, moving messages and transactions across multiple trading partners, in addition to their shared patients.

The Interstitial Market Opportunity

Many enterprise software market segments have become penetrated replacement markets. Interstitial communications in health care represents a new market opportunity. Interstitial communications and workflow automation solutions are a growth market with very limited adoption to date.

These interstitial solutions will not replace the trading partners’ enterprise applications. Successful interstitial solutions will likely overlay existing enterprise apps through a combination of communications and workflow automation clients for trading partner workers independent of trading partner enterprise apps. These native interstitial workflow automation apps will be complemented by some degree of integration with enterprise apps. The degree of integration with enterprise apps will likely vary with the type of trading partner and the ease in which business and technical integration issues can be addressed.

The Path to Connected Care

We've discussed interstitial markets, and why they're a big deal. Next we delved into some of the unique characteristics of interstitial markets. We have discussed solutions that supports the coordination, delivery and satisfaction of patients’ health care experience through coordinated, connected health care. These emerging markets are only going to get bigger, and some of these innovators may end up dominating the HIT market in years to come.

The “Patient Centric” health care system has been here all along, it just uses phones and fax machines.

Sources:

- The "Post EMR" Era, Life As A Healthcare CIO blog, post by John D. Halamka MD

- Readmissions Reduction Program, CMS policy description

- Chronic Care Management Services Changes for 2017, CMS Medicare Learning Network (pdf)

- Meaningful Use Knowledge Hub, athenahealth

- Office of the National Coordinator for Healthcare IT, website about page

- Accountable Care Act of 2010, Wikipedia entry

- Accountable Care Organizations, Explained, Kaiser Health News

- Accountable Care Organization Software: 5 Critical Information Systems, HealthCatalyst

- How Formerly Independent Doctors Were Pushed Out of Business, Reason, August 28, 2018

- Free Healthcare From the Fax, Forbes, August 20, 2018

- Amazon, Google, IBM, Microsoft, Oracle and Salesforce pledge to remove interoperability barriers, Healthcare IT News, August 13, 2018

- SPEECH: Remarks by Administrator Seema Verma at the ONC Interoperability Forum in Washington, DC, CMS press release, August 6, 2018

- The Network Effect Isn't Good Enough, TechCrunch, November 4, 2012

- Strategic Health Information Exchange Collaborative, trade association web site

- OneHealthPort, company website

- Pointshare, Crunchbase entry on Pointshare's acquisition

- CollectiveMedical, company website

- Medical Information Network– North Sound, company website

- Health Care Messaging and Orchestration – Systems of Action, blog post

- Innovation Pulse: A better road to data interoperability?, Healthcare IT News, June 30, 2015

- Pulsara, company website

Tim - Great article. Quick question, what do you (or your readers) think the market value is for Messaging Middleware in the US?

Fax isn’t really that horrible although paper based fax does require a bit of manual manipulation. And lets not forget hand carried, which I have done on several occasions for the non-emergency movement of records from one provider to another. Also not addressed is the enormous amount of stuff (I hesitate to say information) that we transmit to each other via computer, either person to person or involving larger groups. This method can certainly move records as in email or other applications without establishing new real or virtual infrastructures. Privacy may be an issue, but the ongoing level of hacking has perhaps proven that privacy is an archaic concept. I also note that only two of my now multiple providers can see each others records, although given their respective specialties neither has any interest in the other.