Change is disrupting nurse call. After decades of slow incremental change, the pace of change is quickening. These changes impact provider organizations and manufacturers as nurse call is integrated with adjacent market point of care solutions and new technologies. The benefits will be substantial: improved HCAHPS scores, improved patient safety, shorter length of stay and greater staff productivity. Lagging providers and manufacturers will miss out on the benefits of these new capabilities. Let's look at the recent past of the nurse call market and where we might be going in 2019 and beyond.

In this post we'll look at structural elements of the market that are disrupting nurse call and why, and delve into examples of these changes. We'll close with a bit of analysis and prognosticate what might be coming next.

Barriers to Change

Let's start with factors that have fostered the relative stability enjoyed by nurse call vendors for about the past 50 years — the original hospital "sound and communications systems" were founded in the 1960's and 1970's.

Regulatory Barriers

Any new entrants to the nurse call business must overcome a regulatory barrier. In 1977, nurse call manufacturers and the Underwriters Laboratories got together and created the UL1069 standard for Hospital Signaling and Nurse Call Equipment. Not long after, states started to require every hospital patient room include a UL1069 certified nurse call system in order to be licensed.

The mandating of UL1069 by local building codes or state licensure had a number of effects. First, this shut out electrical contractors who might design custom low voltage sound and communication systems to compete with nurse call vendors. The UL1069 standard represents a regulatory hurdle for any new nurse call system or vendor. Because the standard assumes certain features and characteristics typical of a nurse call system from the late 1970s, systems designed with new technologies may not fit neatly with UL1069 requirements. UL1069 may require vendors to change new product designs to conform to the standard's mandated approach that all the other vendors use, limiting innovation and potential sustainable competitive advantages and benefits for customers.

Limited Sales Opportunities

For decades, the acute care nurse call market has been fully penetrated. Sales opportunities are limited mostly to new hospital construction and renovations. The smallest number of sales opportunities are the upgrades or replacements of a nurse call system on a nursing unit that is not also being renovated. Unlike many medical device systems, hospitals rarely replace their 10 or 15 year old nurse call system house wide; replacements are typically done on a per unit basis.

Nurse call systems, especially those associated with new construction and renovations, have a very long sales cycle. Approximately one third of hospitals are using patient communication systems that are at least nine years old. And some of these legacy systems still in use rely on technology from the 1970s.

Nurse call installation costs are expensive due to cable runs and wall mounted equipment. Installation costs contribute to switching costs which inhibits hospitals from changing vendors. The differentiation between most nurse call systems is insufficient to motivate hospitals to change vendors very often.

Most hospitals have one nurse call vendor; these hospitals are hard put to justify a different vendor when doing a renovation or upgrading a few units. The flip side of this is that some nurse call upgrades are purposely forklift upgrades and thus expensive in an effort to generate more revenue for the manufacturer's installed base.

Distribution

A major barrier to change in nurse call has been how vendors distribute their systems. Starting in the early twentieth century, manufacturers would establish two way exclusive deals with dealers. This means that the dealer is the exclusive seller of the manufacturer's system in their geographic area, and the nurse call vendor is the only nurse call system the dealer will represent. Dealers sell and install the systems, and maintain an ongoing relationship with their customers. Dealers went on to have very close relationships with the hospitals and architectural design firms that specify equipment and contract suppliers for new hospitals and renovations in their territory. This distribution arrangement is very difficult for new entrants to break through.

Because of the factors above, startups and vendors in adjacent markets to nurse call don't tend to see a big opportunity in bringing to market a new nurse call solution.

Disrupting Nurse Call

In spite of thee barriers above, change is disrupting nurse call. Finally.

The drivers for this change are divided into inherent opportunities in the nurse call market, nurse call market vulnerabilities, and environmental changes inside and external to the nurse call industry.

Opportunities

When every hospital room is required to have a nurse call, the resulting market is a large one, about $500 million for the US in 2018. In an effort to break into the nurse call market, many vendors have avoided hospitals and targeted outpatient departments, skilled nursing, assisted living and other lower acuity health care provider environments.

Nurse call systems are one of the most patient centric solutions in health care. Because of the essential data generated by nurse call there is a growing trend to integrate nurse call with alarm notification, clinical collaboration and communications, analytics, real time location systems (RTLS) and other systems. Due to this synergy, about half the hospitals in the US currently support these integrations and the trend is growing. As these integration solutions proliferate, nurse call systems take a back seat to higher value point of care initiatives like alarm notification and clinical decision support.

Nurse Call Vulnerabilities

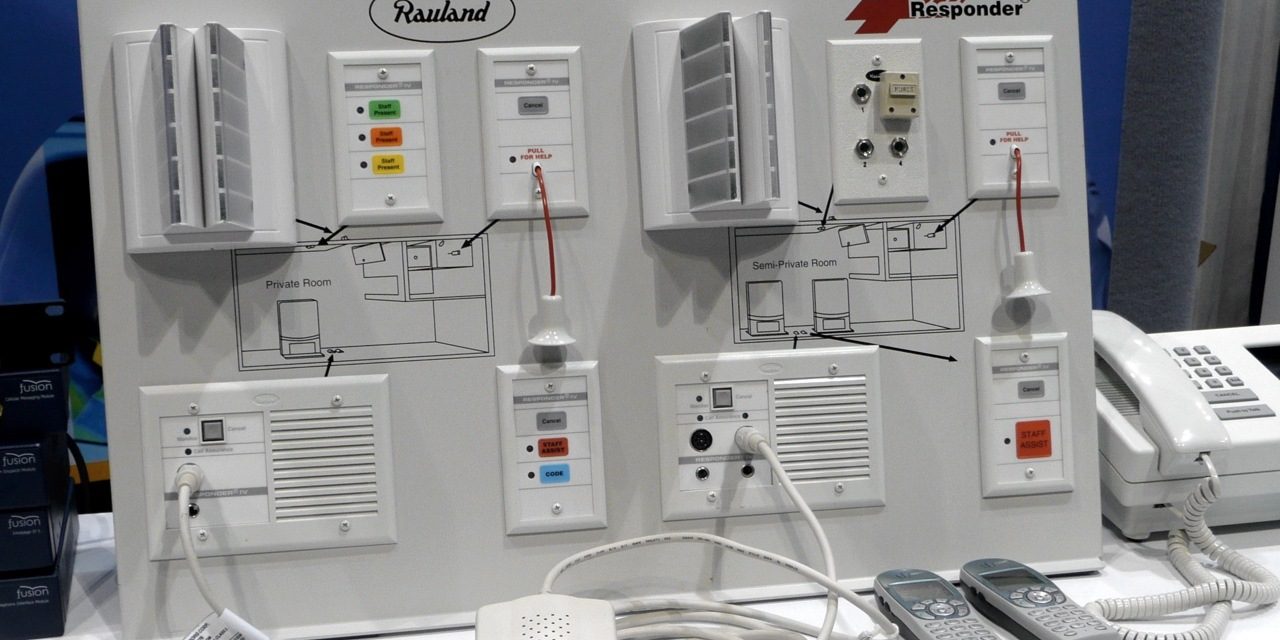

Nurse call is not a high tech market, so the technology barriers to entry are low. Nurse call systems are made up of low voltage wiring, pull switches, pillow speakers, dome lights, a central station console and application software. Some early analog systems have evolved to IP based twisted pair cable based systems with more sophisticated software, including nurse to patient assignments and staff panels to enable more workflow automation. Some manufacturers have released wireless systems to reduce installation costs, especially for markets outside of acute care. Finally, a wide variety of nurse call components are available from third parties like Curbell Medical.

A lack of meaningful differentiation between nurse call solutions is another market vulnerability. Each vendor's solution has the same components (most mandated by UL1069), many of which do virtually the same thing. The most common differentiators are found in application software. Like many other markets in health care, sustainable competitive advantage comes from understanding and supporting workflow rather than adopting some whiz bang technology. (Although I'm expecting to see an AI based nurse call system using blockchain any day now.) Consequently, what differentiation there is has mostly come from improved workflow automation provided by application software and peripherals like staff terminals in the nurse call system.

Interestingly, another important competitive differentiator has been integration with other systems at the point of care. The ability to easily and reliably integrate nurse call with real time location systems, messaging middleware, the EMR and other systems is gaining importance as a competitive advantage.

Market Changes

The one type of variable that nurse call manufacturer's cannot directly impact are the changes occurring at the point of care exclusive of nurse call systems themselves. These changes are occurring with their customers and adjacent markets and include things like new technologies and solutions, reimbursement incentives like HCAHPS scores, Joint Commission alarm management requirements and a continual stream of similar changes.

While most nurse call vendors are open to integrating with other solutions at the point of care, few have interest in expanding beyond the historical scope of nurse call. Many companies, and entire industries or markets, often lack the interest in changing their business as their customers or technology changes. One of my favorite business books, Value Migration, describes the movement of profitability and market value from one industry player to another — often as a result of changes in the market and among customers. This is starting to happen to nurse call.

Hospitals have long held a preference for single vendor solutions. As technologies develop at the point of care, hospitals are increasingly looking to apply the single vendor approach at the point of care. While there is no single vendor solutions for the point of care now, the market pressure for one and the movement of vendors in that direction are clear.

In the heyday of nurse call, in the 1970s and 1980s, the value provided by nurse call systems was paramount at the point of care. Over the last couple decades, the rise of real time location systems, clinical communications and collaboration, analytics, surveillance monitoring and other applications have eclipsed the relative value of nurse call substantially. Let's look at some specific manufacturers and see how their strategies are impacting nurse call.

Ascom

Ascom Wireless released the first component of what has become their Healthcare Platform, back in 2006. Springboarding on their telephony expertise, Ascom released Unite. Unite is what was then called a messaging middleware solution and is now referred to as a clinical communications and collaboration system with alarm notification. I simply call it health care messaging and orchestration.

Later, after the introduction of Unite, Ascom acquired the assets of GE's Telligence nurse call (2012) and developed their own remote surveillance solution, DigiStat. As a result of continued investment, these three solutions are now a tightly integrated common platform. This common platform is now the solution that Ascom brings to the point of care. Certainly individual components of the solution can be acquired and integrated with legacy components (e.g., a preexisting nurse call), but the value story is about the synergy of these three components together. This recasts nurse call to the role of a contributing subsystem and not the apex position it once enjoyed on nursing units.

Hillrom

Like Ascom, Hillrom is also building out a broader point of care solution. A market leader in hospital beds for many years, Hillrom has long tried to move beyond beds and generate new growth with different but related solutions. Hillrom acquired nurse call vendor NaviCare Systems in 2004. Hillrom acquired clinical communications and collaboration vendor Voalte in early 2019. The company rebranded as a "connected care" company a few months later. Combined with Linq, their messaging middleware, Hillrom can now offer integrated nurse call, medical device data acquisition and a messaging platform for the point of care.

Like Ascom, Hillrom sees the competitive advantage of offering an integrated point of care solution that includes nurse call with components from adjacent markets.

Rauland-Borg

The largest nurse call market share is divided almost equally between Rauland and Hillrom. Currently Rauland is the closest to a large pure-play nurse call vendor. They were acquired by Ametek in early 2017 for $340 million, plus an earn-out of $30 million. At the time, the company had annual revenues of approximately $160 million. Rauland has a premier brand in nurse call, and they have extended to the patient interaction adjacent market.

Rauland's current big innovation is improved enterprise wide nurse call data analytics that rolls up to the IDN level. Given that many hospital systems are merging or being acquired to form ever larger IDNs, this looks like a good strategy.

What appears to be missing is relevant data from adjacent systems that would provide important context and make nurse call data much more valuable. Besides nurse call events, data like medical device alarms, messaging statistics between a patient's care team members, bed exits, surveillance monitoring data showing patients with deteriorating clinical conditions — there are many data elements beyond nurse call that administrators want in a point of care analytics solution.

The company that acquired Rauland, Ametek, is a $5 billion conglomerate that acquires midcap companies in a variety of markets, including medical. They look for established market leaders with good cash flow and focus on operational efficiency, cost and asset management to extract value from their acquisitions. One of the optimizations currently being undertaken at Rauland is the refinement of their distribution channel, an often delicate and risky undertaking.

Rauland had a chance to acquire Voalte, but I suspect that even if the company wanted to extend beyond nurse call, Ametek was not interested in investing another third of the capital used to acquire Rauland to get Voalte. A metric used by Ametek to evaluate potential acquisitions is a benchmark of three year return on invested capital (ROIC) of 10%+. Assuming Rauland makes an average net profit of around 10%, Rauland's ROIC would be a nice 12%. Assuming Voalte is not cashflow positive, or barely so, adding their acquisition cost to Rauland's ROIC would bring the ROIC down to 8.5%, too low to meet Ametek's benchmark. Ametek differs from private equity firms like K1 Investment Management who acquired PerfectServe and has since funded three additional acquisitions to combine into PerfectServe. K1 has different investment objectives compared to Ametek and is executing a rollup strategy to build value for a later exit.

Critical Alert

The last company we'll look at is Critical Alert Systems. Critical Alert is much smaller than the previous three companies, but is aggressive in seeking growth and sustainable competitive advantage — and has access to the capital to fund new growth.

Founded in 1983 as WESCOM, the company was rebranded as Intego Systems in 2007. In 2012 Intego was acquired by Critical Alert Systems. Critical Alert was the first software based nurse call system, and the first to integrate a real time location system.

Critical Alert recently brought in John Elms as CEO. John has a track record of shaking things up and successfully growing companies. His broader impact on the nurse call industry will be interesting to see.

In one of John's first moves, Critical Alert acquired Sphere3 Consulting and their Aperum data analytics solution in 2019. The majority investor in Critical Alert, Wedbush Capital Partners, is another private equity investor like K1, aiming to increase company value in anticipation of a profitable exit. Besides providing Critical Alert with an attractive analytics package that is more advanced than those offered by other nurse call vendors, they also gained their new VP of Business Development, Kourtney Govro, the founder of Sphere3. Govro has been in the nurse call world for many years and should be a great asset for Critical Alert as they seek to drive more growth.

Critical Alert is building out perhaps the broadest point of care offering around their nurse call system, including:

- Patient communications

- Clinical communications and collaboration

- Clinical workflow automation

- Clinical surveillance

- Data warehouse and analytics

- Real time location system for workflow automation, wandering and elopement

- Medical device data system and alarm notification

The above capabilities are all combined in Critical Alert's Patient Event Bus. The bus collects information that patients physically or physiologically generate requiring clinician engagement and transfers it to the right person at the right time, using the capabilities listed above — a value proposition that is quite different from most nurse call vendors.

Unlike the previous companies discussed, Critical Alert is a nimble small competitor. As such, all four companies are an example of the directions and kinds of initiatives that could be taken by nurse call vendors, other companies with point of care solutions, or even startups.

Analysis

The goal of Ascom, Hillrom and Critical Alert is to redefine the nurse call market as a component in a broader based point of care solution that is more powerful, easier to use and of greater value than a nurse call system on its own. Their position is, "why buy a just nurse call system when you can buy an integrated point of care system that does so much more?"

Nurse Call and Workflow Automation

As nurse call systems improved their application software, much of the focus was on workflow automation. Use cases like knowing when a caregiver responds to a patient call, recording the response and automatically extinguishing the dome light were implemented by most vendors. Staff panels located inside or just outside patient rooms enabled caregivers to manually indicate their actions from a location more convenient than the nursing station.

While a boon for nurses, message panels are really the optimization of a manual process through a more convenient location rather than true workflow automation. As messaging and orchestration systems have shown, real workflow automation requires a mobile application that can be accessed anywhere and any time. And automatically capturing when the caregiver enters the patient's room requires a real time location system.

To date, nurse call vendors have resisted developing their own mobile applications to automate workflow. A few vendors have developed or OEM'd real time location systems to provide limited workflow automation support. This lack of interest in extending beyond the traditional bounds of nurse call is a key vulnerability for legacy nurse call vendors.

What Should Buyers Do?

Acute care providers must recognize that at some point, nurse call systems will have to be considered within a broader framework of point of care workflow automation. Their current vendor might be acquired, get funding to broaden their offering like Critical Alert has, withdraw to markets outside of acute care, or fail altogether.

In making this transition, it is important to have a 5 year point of care systems roadmap. This roadmap should capture clinical and operational point of care objectives, and how that translates to the other point of care systems currently in use. Additional adjacent market technologies not currently installed should be evaluated within the context of your point of care objectives and broader hospital strategic plans, including nurse call. Finally the roadmap needs to show how and when vendor changes (new solution adoption, end of life, upgrates, etc.) and new technology adoption might happen.

What Should Nurse Call Vendors Do?

Nurse call vendors will eventually have two choices: play the new game of offering a broader point of care solution, or leave the field of competition. In the short term it may be possible to shift sales to markets that are not yet, and may never face this broader point of care shift. These markets include outpatient departments, skilled nursing facilities, assisted living facilities, and ambulatory care services.

Moving beyond the traditional boundaries of nurse call will require addition talent with new skills and capital to fund R&D and maybe an acquisition or two. This means getting access to capital. Early movers in this direction with a solid plan can likely pull this off. But there likely won't be opportunities for more that a few nurse call vendors to do this.

Alternatively, legacy nurse call vendors can sell. Rauland got a three times multiple on revenue for their company, probably the high water mark for nurse call company valuations. Buyers could include companies like Ametek, perhaps a private equity investor (although they'll be looking for growth and a profitable exit), or an acquisition by a vendor in an adjacent market or maybe an EMR or other health care IT vendor.

The good news is that nurse call vendors are not facing immediate threats to their business. There are still two to four years to assess your situation and develop a plan.

The Role of EMR Vendors

EMR vendors are like the sharks of the health care IT world; they must constantly be developing new applications and new markets to drive the kind of year over year growth their investors demand. Can providers just wait and buy all this from their EMR vendor? Perhaps.

Much of the workflow automation in health care delivery does not meet the definition of a medical device. However, when you get to the point of care, where clinicians actually lay hands on patients, it's hard to have a feature rich solution that does not include at least a few components that are FDA regulated. Alarm notification, remote surveillance and some clinical decision support solutions are examples of some of the essential applications that are FDA regulated. To date most EMR vendors (really all of them but Cerner) have avoided FDA regulation whenever they can.

I would not count out EMR vendors completely, but I would be on guard for vendors who want their cake and eat it too. This means offering a broad point of care solution that just coincidentally does not include the FDA regulated components, or uses third parties to provide those components.

Also watch for the spoiler effect where EMR vendors tell you that they're working on a point of care solution and if you'll just wait, you can get it from them. First they want to delay your purchase of software from other vendors so they can capture those budget dollars. They may be working on something, but it remains unknown whether it will be completed and come to market, or how complete or effective the resulting product will be.

Many EMR applications are world class. But EMR vendor efforts in new markets where they have little or no direct experience can be pretty bad. Why finance your EMR vendor's software development by buying a half baked solution while they rely on you to help them figure out what's best?

UL1069

Industry standards can have a number of consequences. Standards can provide a minimal level of interoperability between different company's solutions, lowering integration costs and allowing for multi-vendor solutions. The WiFi Alliance is a great example of this as WiFi infrastructure and radios from various vendors can all work together. This is a boon to buyers as it reduces switching costs and makes purchasing easier. The benefit to vendors is more rapid market growth for all participating vendors.

Industry standards, along with regulations and licensing requirements can be abused for rent-seeking. In this case companies use standards, regulations or licensing as a barrier to entry to limit competition, or as a shield against market disrupting new technologies and new competitors.

Most standards are created by manufacturers with little or no customer involvement. In this process, the participants are constantly jockeying to create an outcome that advantages them and ideally disadvantages their competitors. One of the roles of the group governing or overseeing the standards, regulations or licensing is to minimize or eliminate this rent-seeking behavior.

Sometimes external factors change and what was a fair and effective framework that advantaged buyers and sellers becomes a barrier to innovation and competition. Such standards, regulations or licensure then favors incumbent vendors and disadvantages buyers and innovators. One could make the case that UL1069 it its current form has become a barrier to change.

The solution here is for innovative vendors to engage UL to revise 1069 and bring it up to date. There will have to be enough innovative vendors to be able to out vote incumbent vendors for effective changes to take place. This is neither a quick or inexpensive process, but a task which must be undertaken at some point.

Defining Adjacent Markets

As mentioned, there are numerous product categories or market segments at the point of care. Examples include:

- Medical device data systems (e.g., Bernoulli Health, Capsule Tech, Excel Medical, NantHealth)

- Continuous and spot medical device data acquisition and management for clinical documentation into the EMR, for use by clinical decision support systems and remote waveform surveillance, e.g., central station displays, remote access by physicians, and remote ICUs)

- Point of care analytics (e.g., CareSight, Sphere3)

- Retrospective and near real time analytics of point of care patient and operational data to uncover crucial insights into patient and device vulnerabilities and correlating events

- Surveillance monitoring/clinical decision support (e.g., AlertWatch, Bernoulli Health, EarlySense, Excel Medical, Medical Informatics Corp, PeraHealth, VitalConnect)

- For detecting fall risks, deteriorating clinical conditions, and other risks impacting patient outcomes or contributing to hospital acquired conditions or sentinel events

- Health care messaging and orchestration, including alarm notification (Bernoulli Health, ConnexAll, Medical Informatics Corp, Spok, Vocera)

- A mobile client and server software to enable staff collaboration and alarm notification to improve HCAHPS scores, patient safety and avoid sentinel events

- Real time location systems (e.g., AwarePoint, CenTrak, Infinite Leap, Intelligent In-Sites, Midmark (Versus), Sonitor, Stanley Healthcare)

- Equipment, staff and patient tracking to automate numerous workflows, improve staff and patient safety, and detect wandering or elopement

- Patient entertainment/interactive systems (e.g., CompanionWave, OneView, SonifiHealth)

- Systems that provide television or streaming video for entertainment, along with patient education and operational support for things like patient selections for meals

As these adjacent market segments mature, they will likely be added to growing suites of capabilities offered as point of care solutions.

Summary

The story of nurse call is a fascinating microcosm of the health care industry. Most changes in health care delivery occur at a very slow pace. But sometimes, the pace quickens and health care providers and manufacturers can be caught on the wrong foot.

We have considered the long standing barriers to change as it pertains to nurse call, and some of the factors that are disrupting nurse call. Four manufacturers served as basic case studies on these current changes. From this we've drawn some conclusions and made some recommendations.

Everyone, whether provider, manufacturer or startup, should understand your homework assignments — if not, let me know.

Tim, great job giving a historical and business perspective to what is often a misunderstood industry. An integrated point of care ecosystem is absolutely necessary for customers, but as you point out the players who provide the various components of the solution prefer a walled garden, often at the expense of the customer. Customers deserve better. And I for one, I’m an advocate for standardized open systems.

In my experience, the most successful customers have had a local or regional integrator as their trusted resource and necessary boots on the ground rather than the omniscient far away manufacturer or application developer. Long-term care and feeding is an essential element that is often overlooked. Customers need these technologies, but more importantly, they need them to work and support their initiatives. Suppliers have not done a great job doing this, and customers struggle on their own.

Good article Tim, but your analysis of the space is slightly dated. The 3 major manufacturers are now selling IP programmable field devices and not just analog switched devices. Additionally some of the greatest value of a system like the Responder 5 is that it is able to take a process that used to require paging someone, waiting for them to call back, then tell them what you need and turn that into just pushing a few programmable buttons on the Staff Terminal. Which incidentally can also be added to the EMR.

Also the Rauland advanced analytics is most certainly capable of integration with other systems, anything that speaks HL7 is capable of being put into the reporting. The problem is not the software, but that there are multiple competing analytics platforms out there and it’s easy for a hospital to become overwhelmed with choices.

Robert, sorry I was not more clear. I did say that some nurse call systems had evolved to IP based low voltage systems. Thanks for specifying that 3 manufacturers have made that change (I was not aware of the exact number).

Your improvement in workflow example is a great one that nurse call systems have leveraged for some time. The extension to that, presently being leveraged by Ascom, is to use a nurse-carried smartphone and messaging system to facilitate that patient/nurse interaction and resulting workflow. Yes, all nurse call vendors will integrate with messaging systems to enable that workflow. But, hospitals prefer dealing with fewer vendors rather than more and so a broader integrated solution is preferred, at least theoretically. Also, an integrated solution could theoretically offer better or more complete workflows that solutions made up of separate products integrated after the fact.

I expect that eventually, what we think of as “nurse call workflows” will become part of broader caregiver workflow automation solutions. Critical Alert is one nurse call vendor moving in that direction. Ascom is an example of a vendor from outside the traditional nurse call market that is taking the same approach.

What kind of nurse call workflows could be provided by a company like Vocera with their rounding workflows, or PatientSafe Solutions with their caregiver workflow automation? In a way this is the dawning of a new age for nurse call.

Just read your article on Disrupting Nurse Call. Well done.

I suspect some of our friends in the nurse call business will be challenged with your statements but they certainly can’t deny that they’ve been hiding behind UL1069 and being a hardware driven solution for a long time.

I’m surprised you didn’t mention (or I missed it) new technologies like Alexa or Suri. In Australia, there is a “nurse call” company that uses Alexa-like devices for patients to call their nurse, ask for help, food, water, pain med, etc.

Anyway, I’m sure the market will continue to consolidate like Ascom, Hillrom, and EMR companies who want to sell a more complete solution.

Just as important, buyers want to buy a more complete solution.

It is a popular practice to assert grand but unproven benefits to technology changes. For example here we read “The benefits will be substantial: improved HCAHPS scores, improved patient safety, shorter length of stay and greater staff productivity.” Will any of these benefits actually be measured and shown to be a direct result of changes in nurse call? And by the way, when did being disruptive become a good thing, and does it necessarily mean better or just new and different?

I admit I got carried away with my prose. I was referring to “potential” benefits that must be realized in the products sold and in the implementation of those products in hospitals.

Smart vendors who want to meet their sales forecasts will be sure to capture quantitative benefits of their solutions as early as possible, as buyers are most interested in “proofs” of claims.

Everything changes, eventually — even nurse call. Are smartphones better than candybar cell phones or flip phones? Buyers certainly prefer them. Likewise, with medical device technologies, innovations and disruptions will be driven by new solutions that are preferred by the market. In general, if the market likes a new approach to a solution it must be good enough to earn that preference. If it’s bad, it will generally fail in the market — unless the government is paying the market to adopt new technology like say, EMRs…

Having left a market-leading RTLS company (best in class workflow) for a technology startup in the Sr Housing market (Assisted Living/Memory Care) where the classic ecall (pull cords/pendants/basic wander) solution is now facing cloud-based, open standards (Bluetooth), wearable tech that far, far outdistances the classic solution. Refreshing to see the purity of the technology redirect customer decisions in a less-encumbering manner than the acute care landscape. And yes, there are many reasons why there are dramatic differences in the markets. Our startup then got acquired by Philips to be a contributing part of Philips’ greater connected care vision for those in the aging journey — even more exciting. In essence, our solution replaces ecall…and as we digitize health data we can then elevate up (and contribute!) into the emerging broader aging space (from the home to hospital to sr housing) — where the big players (Apple/Amazon/Google/Philips) are seeking to shape, define and lead in this space to drive better outcomes in a more connected, digital-data centric, sharing manner. Another example of nurse call/ecall elevating as a contributing part of an emerging greater good.