I've written much in the past about the technical and product development issues of connectivity. Just as important are the issues that revolve around successfully selling your connectivity solution. (If you're a provider reading this, this should provide a bit of insight into how to buy connectivity, and why sometimes vendors to the crazy things they do.)

You can place two seemingly identical medical devices side by side, with the only visible difference being that one has an Ethernet connector and the other does not. That "small" change makes a world of difference when it comes to selling these two devices. Here's my list of the areas where adding connectivity to a medical device changes almost everything:

- Required new knowledge

- Qualifying prospects

- Dealing with new decision makers (typically with veto power)

- Selling a solution, rather than selling the box

- Selling one-off systems, rather than cookie cutter widgets

- Aligning incentives

- Making it work, getting paid

- Keeping the customer happy, keeping the system working

- Customers want a whole product solution

We'll look at each of the topics above in a separate post in the coming days and weeks. And we'll close out this post by answering the general question, "what's the big deal?"

Imagine you've sold medical devices for 10 or 15 years; if you're pretty good at, you've probably sold for the same vendor over that time. You know all your customers - you even know some of their spouses and kids. You know next to everything about your product, the technology and the clinical issues around the use of your product. You've heard all the questions and know all the answers. You work hard, but you're in a comfortable secure place. If you're a top rep, you probably put in 12 hours a day or more pulling down $250,000 to $400,000 a year - or more. Rumors are making the rounds that a new product is in development that includes connectivity.

On the other side of the table is the provider, a senior tech, manager, or director. You've been using the medical device in question most of their career - every bit as long as our rep's been selling. You've been on purchase committees numerous times. You know all the questions to ask, especially the hard ones, and you know most of the answers. What started out as a vague dissatisfaction with how your department operates has grown to a strong desire to have a system that takes that medical device data and does something with it - something like automated data analysis, report generation and a database, or maybe order management, remote surveillance and alarm notification. Your institution is going to be making a big purchase next year, and the rumor is that device vendors who can't provide all or most of these new features need not apply.

What might this new connectivity product be?

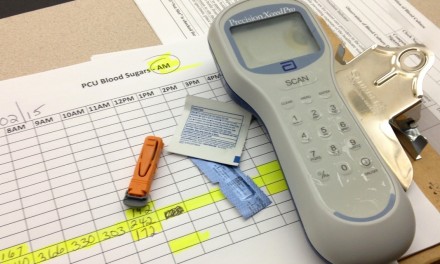

For most diagnostic modalities, and certainly diagnostic imaging, this transition happened many years ago. Same for patient monitoring and fetal monitoring. Infusion pumps are still working through the transition to connectivity features. Point of care diagnostic testing is just in the early (painful) stages of adopting connectivity. There are also numerous (relatively) less expensive products, like SpO2 monitors, that are on the precipice of connectivity. One of the last major device categories to fall to connectivity are ventilators. Recent news that CMS is going to stop reimbursing hospitals for ventilator acquired pneumonia may finally push this market to connectivity.

So we've listed the issues and set the stage. The next entry in the series will deal with all the new knowledge that both the buyer and seller need to deal with connectivity.

UPDATE: You can find the following installments at their respective links:

Trackbacks/Pingbacks